What is Cash Conversion?

What does the Cash Conversion Cycle measure?

The importance of the Cash Conversion Cycle for your small business.

What is the Cash Conversion Cycle?

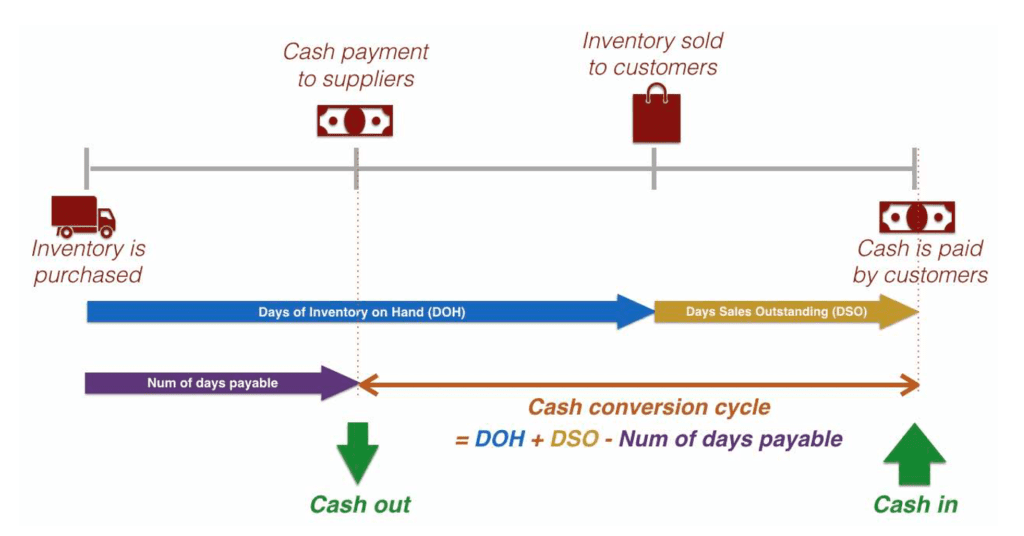

In the financial world, the cash conversion cycle (CCC) measures the time it takes a business to convert its investments, such as inventory, into cash.

What is a Sales Cycle?

A sales cycle is characterized by the continuous flow of inventory, promotion, and sales. When you decide to invest in more inventory, you are already in the process of building a sales cycle. The inventory must then be displayed and sold, and accounts receivable must be credited for the actual purchase price.

The Importance of Finance in Business.

Managing the finances of a small business means ensuring that there is enough money available to initiate, operate, and expand the business. The financial health of a small business is critical because it needs to be able to cover its current operating expenses. In addition, it needs to generate enough revenue to be profitable so that your business has the ability to continue to thrive and grow. Companies with positive financial conditions are more likely to be able to explore new products or services as well as new markets that will facilitate the ability to create more assets for the business, this can be investments or additional stock.

The cash conversion cycle, also known as the net operating cycle, is a measure of how rapidly your business pays vendors and suppliers. It is also a measure of how soon your business pays for the costs associated with those purchases. The CCC monitors your business performance step by step; from when you purchase inventory to when you reimburse them for those purchases. In addition to providing you with a great deal of information about your business, the CCC also performs numerous calculations to reach its final result.

A low CCC number is ideal for your business, which means that your business will be able to sell inventory and collect those sales in a timely manner. Your CCC can provide you with the information and the tools that you need to make necessary adjustments to your business. This includes increasing sales or chasing those sales invoices that have not been paid.

There are other calculations that may be more suitable if you do not have inventory on hand in your small business. However, if your business involves selling inventory, it is always a smart idea to calculate the CCC. There is one thing that is spectacular about the cash conversion cycle formula. This is the fact that it is based on variables that can be picked directly from the company’s financial statements, including the income statement and balance sheet.

Operating cycle vs cash conversion cycle

When it comes to operating cycles and cash conversion cycles, what is the difference?

Operating Cycles: An operating cycle can be defined as the number of days that elapsed between the time when you purchase inventory and the time when your customers pay for that inventory.

Cash Conversion Cycles: The cash conversion cycle, on the other hand, measures the number of days that pass between when you pay for inventories and when your customers pay you for the same inventories.

What does the operating cycle indicate about a company’s performance?

Based on this metric, you can determine how much working capital your business needs in order to grow or maintain its growth. Having a short operating cycle will result in fewer cash requirements to operate your business. Even if your business is selling inventory at low-profit margins, it is still possible for it to grow.

Why is a healthy cash conversion cycle so important?

It is imperative for a company to maintain an efficient cash conversion cycle as it indicates the efficiency of the inventory chain. It has already been discussed that a low CCC is good for your company, but, on the other hand, if the CCC of your company is high, it means that there are either inventory issues or financial issues that need to be dealt with in your organization.

If you are looking to better understand Cash Conversion Cycle, reach out to Cash Flow Mike where we will be happy to help and provide you with bespoke tailored training to help you fill this important void.

P.S. Whenever you’re ready… here are 4 ways Mike can help you improve Cash Flow in your business.

- Grab a free copy of my book:

In The 7 Minute Conversation, you’ll learn how to analyze any company’s financial statements in 7 minutes or less. It includes a super valuable lesson on controlling expenses. — Download Here.

- Join the Clear Path To Cash – Mining Your Business For Hidden Cash Facebook Community:

This is our new Facebook community where business owners who are using the concepts taught in The Clear Path To Cash can share lessons learned and receive advice from my team and other members of the community. — Join Our Facebook Group.

- Participate in a Live Virtual Clear Path To Cash Seminar:

There are some people who prefer to learn concepts through self-study through books or video series. For others, such as myself, it is necessary to be in a classroom environment and to be guided through the concept. We offer a Virtual Seminar each month. It takes only three hours each day for two days, during which you will learn about The Clear Path to Cash Program’s eight steps.

I am so passionate about this one that I teach it myself. — Virtual Seminar.

- Work with me and my team privately:

If you’d like to go over something outside of a group setting, no problem. All you have to do is click this link to schedule a 15-minute Triage Call. In 15 minutes, we see if my team can help you with your problem. Sometimes we can give you some advice on the spot, other times we will invite you to a longer Burning Issues call, where we dig into the issue a little deeper and give you some great advice. Even if we don’t believe our program is a good fit for you, we try to connect you with the right professional from our network of friends. — Schedule Your Triage Call.