Diving into Cash Flow Statements by Understanding The Direct and Indirect Methods.

Welcome/Thanks for coming back to blog #5 in the series.

In this blog, we are going to look at and understand the difference between the Direct and Indirect Methods of Cash Flow. The Cash Flow Statement is a financial statement that documents the movement of cash and cash equivalents that flow in and out of the company.

The cash flow statement is divided into three segments:

- Operations – Both earnings and expenses are included in this category, including money earned from products and services the company provides.

- Investments – This includes the returns the company gets on money it has invested and the cash it spends to acquire and manage these investments.

- Financing – This refers to the money the company has coming in from the either the debt or shareholder investments it uses to finance its operations, as well as the cash it spends on this debt or to pay dividends to owners.

The combination of these elements is called net cash flow, making the cash flow statement an excellent snapshot of the company’s financial health. It also gives investors a high-level view of the factors contributing to the company’s strength.

How is Cash Flow Calculated

There are two methods of calculating cash flow: the Direct method and the Indirect method.

While both of these methods will produce the same figure at the bottom of your cash flow statement, each is calculated slightly differently. The difference between the two methods relates to the presentation of cash flow from operating activities, while cash flow from investing and financing activities remain the same.

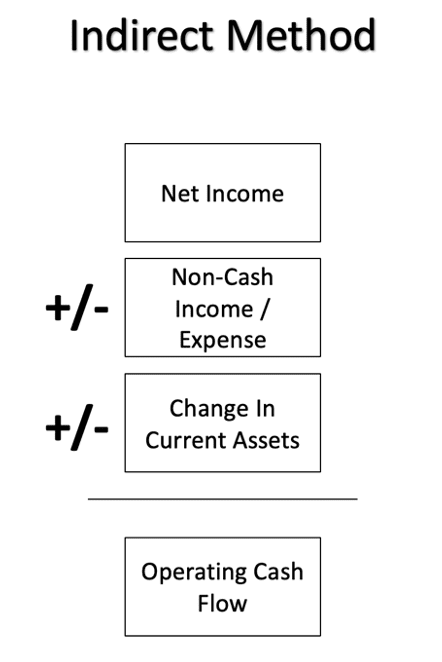

Indirect Method Cash Flow

The indirect cash flow method calculates cash flow based on the profit and loss statement, which is a more straightforward method. This is because the indirect method for cash flow doesn’t require all the details of every cash movement. For example: the date and amount of cash received when a customer pays for goods. All the figures needed for the cash flow indirect method are on the income statement and the balance sheet.

The indirect method to calculate net cash from operating activities is a relatively simple process. You simply take the net revenue from the income statement and add back depreciation. Then, record the changes in current assets, current liabilities and other sources on the balance sheet.

This is the preferred method of most business and is taught in detail in our small business owners training program, The Clear Path To Cash.

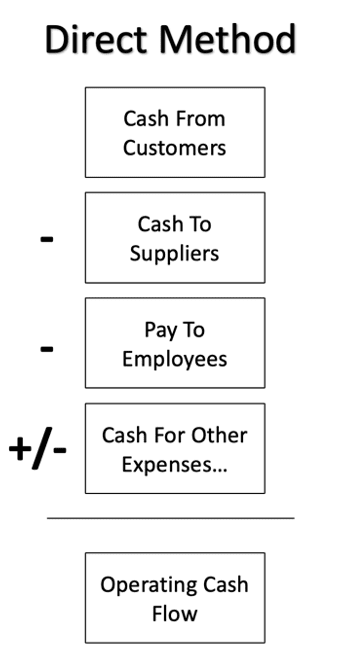

Direct Method Cash Flow

Direct cash flow is an accounting method that produces a detailed statement of the changes in cash over a particular period. This report also indicates changes in cash payments and receipts from company activities. A direct cash flow method involves subtracting cash payments during the accounting period, such as payments to suppliers, employees, cash receipt operations, and customer receipts. In this way, the company’s operating expenses are deducted from its net cash flow in order to compute the company’s net cash flow. Due to its inclusion of actual cash flows in the calculation, the direct method is more accurate than the indirect method. However, it is more time-consuming unless appropriate cash flow management software is used. Here is a diagram to help highlight the difference from the diagram above.

The use of direct and indirect methods has both advantages and disadvantages, as will be discussed in the next blog.

Conclusion: It is important to note that the Direct and Indirect Cash Flow methods are both useful at different points in the business cycle and can be used depending on the situation and requirements. Among companies, the indirect method is the most popular.

Alternatively, the direct method does not require any preparation time other than the separation of cash transactions from non-cash transactions.

Wanting to dive deeper and understand more about Direct and Indirect Methods when it comes to Cash Flow, we have a lot of materials that can help you.

If you feel, want or need to understand more regarding Cash Flow here are 4 ways Mike can help you improve the Cash Flow in your business.

- Grab a free copy of my book:

In The 7 Minute Conversation, you’ll learn how to analyze any company’s financial statements in 7 minutes or less. It includes a super valuable lesson on controlling expenses. — Download Here.

- Join the Clear Path To Cash – Mining Your Business For Hidden Cash Facebook Community:

This is our new Facebook community where business owners who are using the concepts taught in The Clear Path To Cash can share lessons learned and receive advice from my team and other members of the community. — Join Our Facebook Group.

- Work with me and my team privately:

If you’d like to go over something outside of a group setting, no problem. All you have to do is click this link to schedule a 15-minute Triage Call. In 15 minutes, we see if my team can help you with your problem. Sometimes we can give you some advice on the spot, other times we will invite you to a longer Burning Issues call, where we dig into the issue a little deeper and give you some great advice. Even if we don’t believe our program is a good fit for you, we try to connect you with the right professional from our network of friends. — Schedule Your Hidden Cash Call.