What Are The Different Types of Cash Flow?

Welcome/Thanks for coming back to blog #3 in the series.

What are the different types of Cash Flow?

In business, there are three cash flow types or categories that companies should track and analyze to determine the liquidity (how fast can assets be converted to cash) and solvency (the ability to pay your debts) of the business:

- Cash Flow from Operating Activities.

- Cash Flow from Investing Activities.

- Cash Flow from Financing Activities.

It is significant to note that all three categories of cash flow activity are included in the Cash Flow Statement of a company.

This article should help you get a better grasp on what cash flow is, and how you will be able to differentiate between the three different types of cash flow. Ultimately the statement of cash flow is the “tattle tale” of the business. It tells anyone who understands it, exactly where the money came from in your business and exactly what you have done with it.

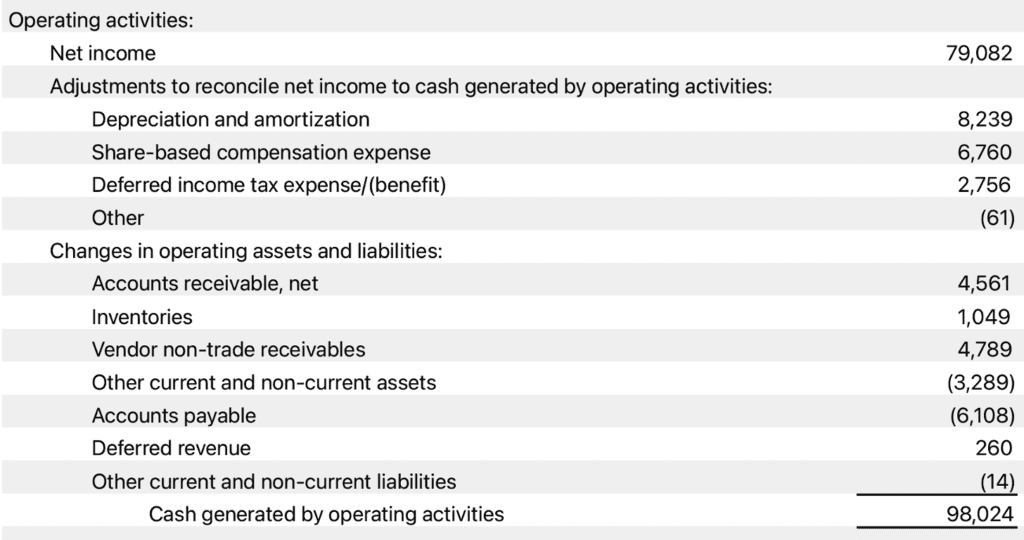

Cash Flow from operating activities: (CFFO) represents the total amount of cash generated from operating activities throughout a specified period. The CFFO indicates how much money a business is bringing in from its regular business activities. This does not include long-term capital expenditures, revenue from investments, or expenses. Operating cash flow is an indicator of how well the business can generate cash balances to cover its expenses.

Cash Flows from Operations is the first section in the statement of Cash Flows, which is one of the three primary financial statements. Generally, the items categorized in CFFO can be found on the income statement.

Using Apple as an example, Cash Flow from Operating Activities for the nine months ending June 25, 2022, was $98M, representing a positive impact on cash generated by their core business – they made money.

Cash Flow from Operating Activities consists of any sources or spending on money that has to do with a company’s everyday business activity. The cash that was generated or spent on the business’s services or products may be found in this section. This includes wages, generated revenue from the sale of services and goods, paying a supplier for goods and more. When a company has negative Cash Flow from operating activities, this can indicate a need for additional cash to either maintain operations or generate positive cash flow statements. Additionally, understanding one’s CFFO provides businesses with a more thorough understanding of where money is being generated and where money is allocated to.

CFFOs provide businesses with the capability of analyzing and planning for the future to generate positive cash flow statements.

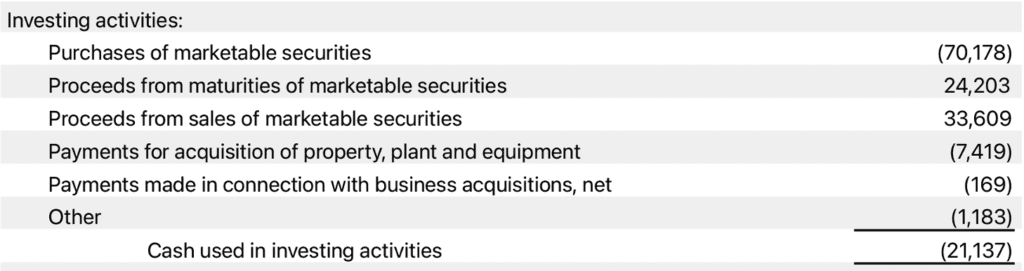

Cash Flow from Investing Activities: (CFFI) provides an account of cash used in the purchase of non-current assets–or long-term assets– that will deliver potential value in the future. Investing Activity is an instrumental aspect of growth and capital. An example of this can be analyzed with Apple’s quarterly Condensed Consolidated Statement of Cash Flows.

Apple’s cash flow from investing activities for the nine months ending June 25, 2022, was ($21M). It shows a negative impact on cash indicating that Apple used cash to invest, mainly in marketable securities.

The importance of understanding the connection between the Operating and Investing Activities is to understand that the company made money with its core business and used a percentage of the cash generated from the business to invest. These numbers tend to show where the money came from and what the company did with it. A positive number means that cash came into the business, while a negative number suggests that the company used cash to buy assets, pay a debt, or distribute to shareholders.

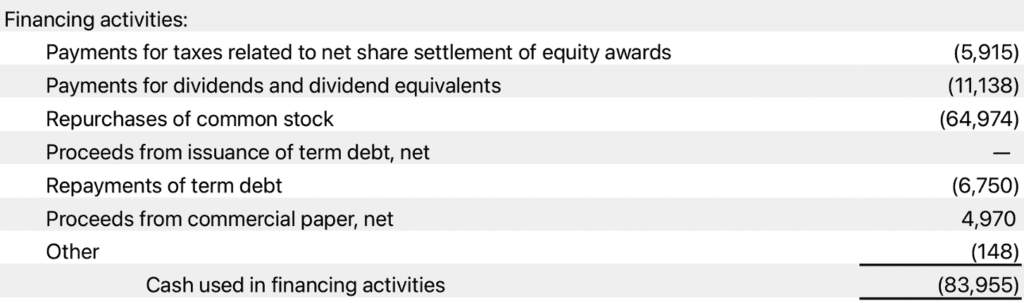

Cash Flow from Financing Activities (CFFF): Financing Activities (CFFF) indicates how much cash it has available to buy back shares, repay debt, pay dividends to shareholders, and raise capital through equity or debt issuances.

The formula for calculating the cash from the financing section is as follows:

Cash from Financing = Debt Issuances + Equity Issuances + (Share Buybacks) + (Debt Repayment) + (Dividends).

Using Apple as an example, like above, Cash Flow from Financing Activities was ($84M). It is evident that this year Apple believes its stock is undervalued and spent money repurchasing stock from the market.

Finally, the Cash Flow from Financing is the third and final section of the statement, hence why within this blog, it too is the last.

In order to arrive at the “Net Change in Cash” line item, the cash from financing must be added to the prior two sections and the Cash from Operating Activities and the Cash from Investing Activities.

In closing, the way we would interpret Apple’s Statement of Cash Flows is that they made money in their core business, and they used cash to invest in marketable securities and buy back their own stock.

If you feel, want or need to understand more regarding Cash Flow here are 3 ways Mike can help you improve the Cash Flow in your business.

- Grab a free copy of my book:

In The 7 Minute Conversation, you’ll learn how to analyze any company’s financial statements in 7 minutes or less. It includes a super valuable lesson on controlling expenses. — Download Here.

- Join the Clear Path To Cash – Mining Your Business For Hidden Cash Facebook Community:

This is our new Facebook community where business owners who are using the concepts taught in The Clear Path To Cash can share lessons learned and receive advice from my team and other members of the community. — Join Our Facebook Group.

- Work with me and my team privately:

If you’d like to go over something outside of a group setting, no problem. All you have to do is click this link to schedule a 15-minute Triage Call. In 15 minutes, we see if my team can help you with your problem. Sometimes we can give you some advice on the spot, other times we will invite you to a longer Burning Issues call, where we dig into the issue a little deeper and give you some great advice. Even if we don’t believe our program is a good fit for you, we try to connect you with the right professional from our network of friends. — Schedule Your Hidden Cash Call.